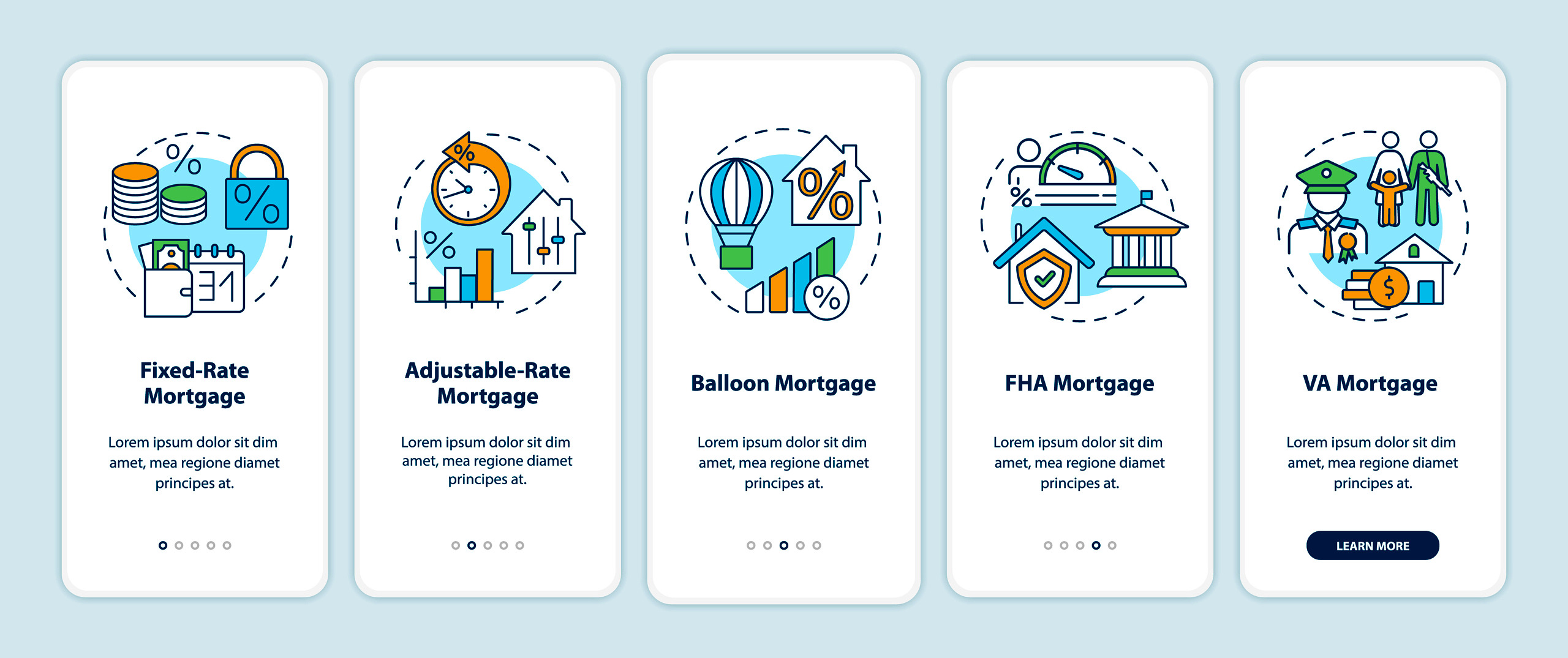

Purchasing a home is one of the most significant financial decisions you’ll make in your lifetime. When financing your dream home, plenty of options are available in the mortgage market. Each type of mortgage comes with its features, advantages, and disadvantages. To make an informed decision, it’s essential to compare the various types of mortgages available. In this article, we’ll explore and compare some of the most common types of mortgages, helping you navigate the complex world of home financing.

Fixed-rate mortgages are one of the most traditional and straightforward options available. With this type of mortgage, your interest rate remains constant throughout the loan term. The most common times for fixed-rate mortgages are 15, 20, or 30 years. The predictability of fixed-rate mortgages makes them attractive for many homebuyers, as your monthly payments remain consistent over time.

Pros:

Predictable monthly payments, which makes budgeting easier.

Protection against rising interest rates.

Long-term stability.

Cons:

Initial interest rates may be higher compared to adjustable-rate mortgages.

Limited flexibility if market interest rates decrease.

Adjustable-Rate Mortgages (ARMs)

Adjustable-rate mortgages offer a dynamic interest rate that fluctuates over the life of the loan based on market conditions. Typically, ARMs begin with a fixed-rate period, often 3, 5, or 7 years, before the interest rate adjusts annually. These mortgages often have lower initial interest rates than fixed-rate mortgages but come with potential interest rate increases in the future.

Pros:

Lower initial interest rates and lower initial monthly payments.

Possibility of benefiting from decreasing interest rates.

Ideal for short-term homeowners or those who expect their income to rise.

Cons:

Uncertainty regarding future interest rate adjustments.

Potential for higher monthly payments if interest rates rise.

Risk of payment shock after the fixed-rate period ends.

Interest-Only Mortgages

Interest-only mortgages allow borrowers to pay only the interest portion of the loan for a specified period, typically 5 to 10 years. After this initial period, borrowers must start paying both principal and interest. These mortgages can be enticing for those seeking lower initial payments but come with risks.

Pros:

Lower initial monthly payments.

Ideal for borrowers with fluctuating incomes.

Potential to invest the saved money elsewhere during the interest-only period.

Cons:

Balloon payments when the interest-only period ends.

Limited equity build-up during the interest-only phase.

Risk of being unable to afford higher costs when principal payments kick in.

FHA Loans

FHA (Federal Housing Administration) loans are government-backed mortgages designed to help first-time homebuyers and those with lower credit scores. They require a higher down payment (usually 3.5% of the purchase price) and more flexible qualification requirements.

Pros:

Lower down payment and credit score requirements.

Competitive interest rates.

Assumable by future buyers, potentially increasing resale value.

Cons:

Mortgage insurance premiums may be required for the life of the loan.

Loan limits may restrict the purchase of high-value homes.

Property must meet specific standards to qualify.

VA (Veterans Affairs) loans are exclusively available to eligible veterans, active-duty service members, and specific National Guard and Reserves members. These loans typically require no down payment and offer competitive interest rates.

Pros:

No down payment is required.

No private mortgage insurance (PMI) is required.

Low interest rates and favorable terms for veterans.

Cons:

Eligibility requirements based on military service.

A funding fee may apply.

Limited to primary residences.

Selecting the right mortgage is a critical decision in the home-buying process. Your mortgage type should align with your financial situation, long-term goals, and risk tolerance. You can make an informed choice that suits your unique needs by comparing the various options available. Remember to consult with a qualified mortgage professional to explore these options further, as they can provide personalized guidance based on your specific circumstances. Ultimately, the right mortgage can help you achieve the dream of homeownership while maintaining your financial stability.